A Global Review of Crypto M&A

Alessandro Bianchi says typically, mergers and acquisitions (M&A) are often conducted by large corporations. Such institutions aim to retain market dominance by growing new talent, expanding market reach, and improving operational capacity. Some M&A transactions may aim to limit market competition. In crypto, M&As help fund struggling projects. The M&A process requires deep pockets, and parties often conduct the process with high confidentiality. Arguably, pulling off a successful a M&A transaction requires parties to be very trustworthy of each other.

Crypto VC funds have increased in the recent past. The biggest of these include Coinbase Ventures, Andreessen Horowitz (a16z), and Binance Labs. These resource pools have overseen success of crypto protocols, advancing efficiency of blockchain solutions.

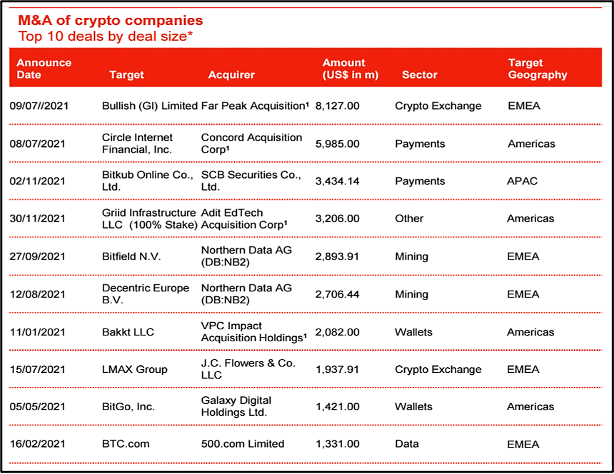

Acquisitions and Deal Sizes

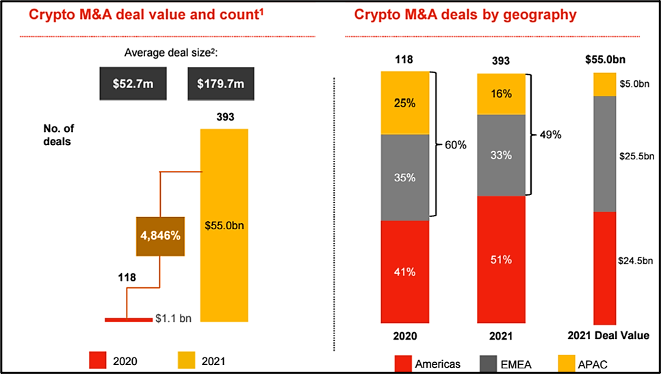

A report by PwC indicates a surge in crypto M&A activity from 2020 to 2021. As crypto prices remained bullish through 2021, the value of crypto M&A soared by 4,800% from 2020. About $55 billion worth of crypto settled M&A processes in 2021, up from $1.1 billion the previous year. Some of the top M&A deals of crypto firms in 2021 include Far Peak Acquisition-Bullish Limited for $8 billion and Concord Acquisition Corp-Circle Internet Financial for $6 billion. The average deal size for crypto M&As for the year was about $180 million.

Top Crypto M&As of 2021

Most crypto M&A transactions that closed in 2021 were in the Americas. This region accounted for 51% of all deals, compared to Europe, the Middle East, and Africa’s (EMEA) 33% and the remaining 16% in the Asia Pacific. Despite the Americas having the most deals, the EMEA region led in deal value. Primarily, deals conducted in EMEA were on average of higher value than those in the Americas and the Asia Pacific.

PwC Report Comparing M&A Activity in 2020 and 2021

Crypto Funds and Investments

Crypto M&A transactions are expected to grow, owing to the expanding markets for blockchain products, and the simplified funding processes powered by crypto.In addition, more crypto investment funds have entered the market. 49 new funds were added in 2021 alone, bringing the total to over 500 VCs and crypto funds. Evidently, there’s an increasing appetite among investors to enter crypto markets. Since the sector is in its formative stages, crypto provides a massive potential for growth and consequently, huge returns. Crypto funds are helping accelerate blockchain projects, and the technology’s novelty means that new products are readily adopted if they offer practical solutions. Today’s investors are hungrier for success, owing to previously successful crypto funds. The investors are also looking to diversify their investment portfolios with crypto assets through the funds.

Prospects for 2022

As new crypto trends emerge, especially with the uptake of the metaverse, M&A transactions will be inevitable through 2022. Despite falling crypto prices, enthusiasts remain optimistic that the markets will bounce back. Also, funding crypto for M&A is more accessible as the decentralized nature allows individuals to invest from any place in the world. The dismal crypto market performance, however, will should reduce the number of M&A transactions this year.

About Chatsworth Securities LLC

Chatsworth Securities LLC is an investment banking firm that has been providing financial advisory services to corporations and entrepreneurs since 1996. Chatsworth advises on both domestic and international M&A transactions, fundraising and capital raises for large and small companies around the globe. Chatsworth has participated as an underwriter in over six hundred public offerings and has raised over $5 billion for traditional and alternative money managers and their funds.